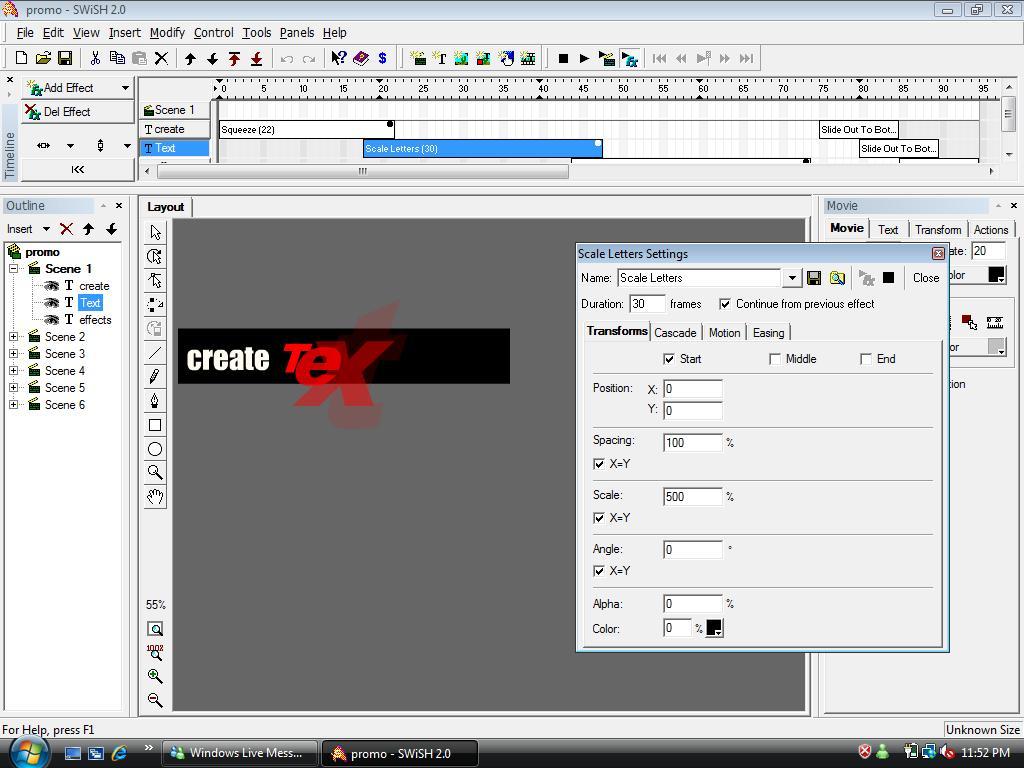

It is backed by Sweden’s central bank – Sveriges Riksbank – as well as the “Bankgirot” national clearing system, which enables payments between individuals and companies on the Swish system to be made instantly. It has attracted a user base of more than two-thirds of the entire population, and has even spawned its own Swedish slang word – “swisha”, meaning to make a payment on the Swish app. Swish is a payments network at the forefront of this Swedish trend, facilitating mobile transactions between both individuals and businesses through a co-operation between some of the largest banks operating within the country. Sweden has led the way in the wider Nordic region’s digital transformation in payments, with a national economic infrastructure that has made significant advances towards becoming a cashless society. Mobile-based payments are becoming ever more popular across Europe as technology gives consumers the ability to make purchases and money transfers on the go. Here we take a closer look at the app-based payments tool.

Swish has been a driving force behind Sweden’s digital payments revolution, which has pushed the country ever closer to becoming a cashless society. Swish enables instant payments between individuals and firms (Credit: Swish)

Swish is at the forefront of a digital payments transformation in Sweden, with more than 6.9 million people using the mobile app to send and receive money

0 kommentar(er)

0 kommentar(er)